In spite of the gains Nigeria recorded in the cashless segment of the economy where trillion worth of transactions are now recorded daily, currency-in-circulation and the currency outside banks have maintained an upward trend, surpassing the levels that warranted the botched naira redesigned policy implemented by Godwin Emefiele, former governor of CBN in late 2022 through the first quarter of 2023.

Based on the latest data by the Central Bank of Nigeria (CBN), from January to June 2024, currency in circulation averaged N3.86 trillion while the currency outside banks averaged N3.57 trillion. On a month on a month basis, the highest currency in circulation during the first six months of 2024 was N4.05 trillion in June 2024 while the corresponding currency outside banks was N3.79 trillion during the same month.

It should be recalled that the former CBN governor, Godwin Emefiele, implemented a naira redesign policy from the last quarter of 2022 through the first quarter of 2023, nearly pushing the Nigerian economy to a halt.

As at the time the naira redesign policy was implemented in late 2022 by the immediate past CBN governor Godwin Emefiele, the average currency in circulation was N3.12 trillion while the corresponding currency outside banks was N2.68 trillion.

Currency in circulation fell as low as N982.09 billion in February 2023. The lowest currency outside banks was N792.18 billion in January 2023.

While small businesses were gravely affected, Nigerians quickly adjusted and adapted, as online transactions soared from 2022 thereafter. According to the electronic payment data by the Nigerian Interbank Settlement System (NIBSS), total electronic payments in the country rose from N387 trillion in 2022 to N600 trillion in 2023.

Point of Sale (POS) transactions increased from N8.39 trillion in 2022 to N10.73 trillion in 2023. This is as the number of POS terminals deployed continues to increase following the rising adoption of electronic payment in Africa’s most populous nation.

According to Fintech Magazine Africa, POS terminals in Nigeria rose from 1.8 million units as of March 2023 to 2.7 million units as of March 2024.

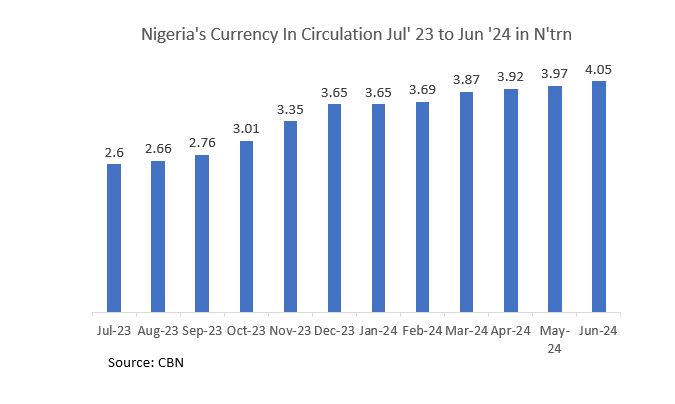

Notwithstanding the increasing number of POS terminals and higher usage of other electronic payment platforms, currency in circulation has maintained an upward trend from July 2023 when it was N2.595 trillion as it rose further to N2.66 trillion in August; N2.76 trillion in September; N3.01 trillion in October; N3.348 trillion in November, before settling at N3.65 trillion in December 2023.

In 2024, it gradually rose from N3.65 trillion in January to N3.69 trillion in February, and further to N3.87 trillion in March. Currency in circulation was N3.92 trillion in April 2024, and it increased to N3.96 trillion in May before attaining the new high of N4.04 trillion in June 2024. Similar pattern was observed in the currency outside banks.

“The rising inflationary trend in the country is one of the factors responsible for higher currency in circulation and currency outside banks. A transaction that cost N2,000 a few months ago is about N7000 now, which means you need more money to execute the same level of transaction,” an analyst who pleaded anonymity, said.

“You should not forget that President Tinubu did not continue with the naira redesign policy,” he added.

Headline inflation in Nigeria slowed to 33.40 percent in July 2024, after 19 months of rising. Before now, it rose as high as 34.19 percent in June 2024. Food inflation also fell to 39.53 percent in July after the year high of 40.87 percent in June 2024.

The rising currency in circulation and currency outside banks comes with a cost to the Nigerian economy. In 2021, the CBN spent N15.23 billion to print new naira notes, and that cost surged to N29.65 billion in 2022.

Meanwhile, an analyst has opined that the rising currency in circulation has little effect on Nigeria’s inflation rates.

“The uptick in inflation despite a fall in the growth rates of currency outside banks and currency in circulation lends more credence to knock off the purported claim that 85% of currency outside banks is the main reason for rising consumer prices in Nigeria,” Oyadeyi Olajide said.