Investment and financial experts under the aegis of the Chartered Institute of Stockbrokers (CIS) have emphasised the need for efficient and affordable access to financing and creating special platforms for the listing of Small and Medium Enterprises (SMEs) as part of the strategies Nigeria should implement towards raising the country’s gross domestic product (GDP) to $1 trillion.

These were parts of the recommendations made at the 28th Annual Conference of the Chartered Institute of Stockbrokers (CIS), in Ibadan, the Oyo State capital. The annual conference has been the platform for the appraisal of the economy and offering professional suggestions on how to move the nation forward.

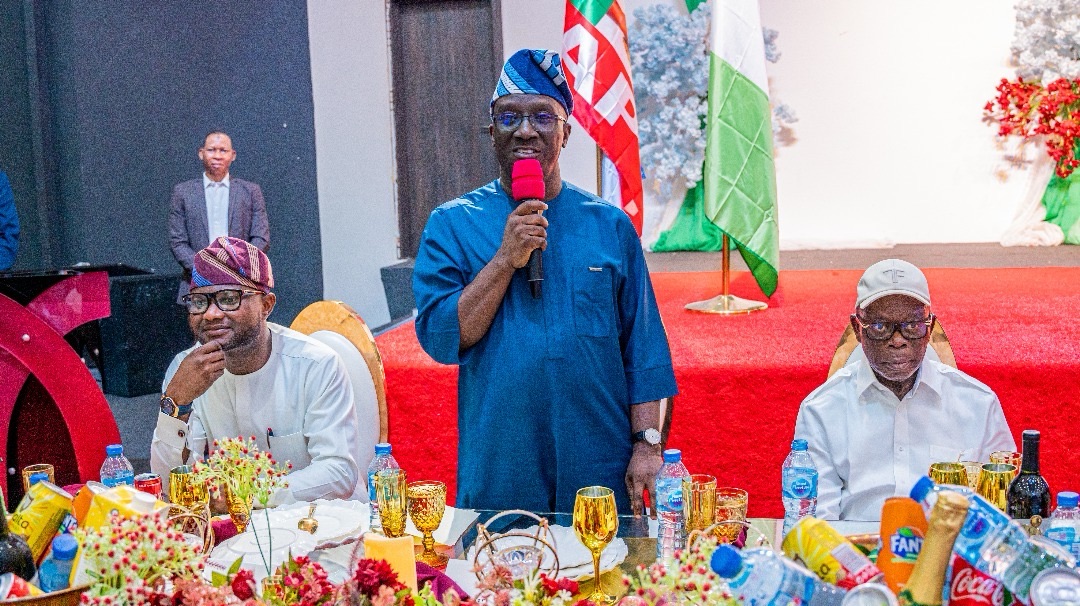

Welcoming the delegates to the annual conference and providing an insight on what informed this year’s theme, which was ‘’Capital market as a catalyst for $1 trillion economy”, Oluropo Dada, the 13th President and Chairman of Governing Council, Chartered Institute of Stockbrokers (CIS), said the theme was chosen in order to help fast track the attainment of one of FG’s cardinal objectives.

“The theme was deliberately crafted to serve as the Institute’s contribution towards achieving one of the Federal Government of Nigeria’s cardinal objectives, which is growing the GDP of Nigeria to $1trn as quickly as possible,” Dada said.

“The capital market plays a pivotal role in any nation’s economy, especially as government and private organisations at various levels harness it to mobilize capital for their broad and varying needs, making people with ideas become entrepreneurs and helping small businesses grow into big companies. Likewise, it is an avenue to democratize assets through wealth creation and distribution, since individuals, corporates and even governments can participate in the fortune-making and distribution, as they provide opportunities to save and invest for our futures,” he added.

Dignitaries in attendance include the members of the CIS governing council and management team, as well as Dr. Emomotimi Agama, DG, Securities & Exchange Commission (SEC); Prof. Pius Deji Olanrewaju, President/Chairman of Council, Chartered Institute of Bankers of Nigeria(CIBN); Amos Azi Esq – Honorable Commissioner/CEO, Investment & Securities Tribunal; Olufemi Shobanjo, Chief Executive Officer, NGX Regulation Limited; Sam Onukwue, Chairman, Association of Securities Dealing Houses of Nigeria (ASHON); Prof. Maryam Abdu, Professor of Finance at Kaduna State University; Prof. Uche Uwaleke, Professor of Finance & Capital Market, Nasarawa State University; Abdulrahman Yinusa, GMD/CEO, Odu’a Investment Company Limited; Johnson Chukwu, Managing Director/CEO, Cowry Asset Management Ltd, and Adetilewa Adebajo, CEO, CFG Advisory.

The roll call also included Olubukola Rufai, Director, Securities & Exchange Commission (SEC), Lagos Office; Jude Chiemeka, CEO, Nigerian Exchange Limited (NGX); Haruna Jalo-Waziri, Central Securities Clearing System (CSCS) Plc; Eguarekhide Longe, Managing Director, NASD OTC Exchange Plc, and Kemi Awodein, President, Association of Issuing Houses of Nigeria, as well as Aminu Umar Sadiq, Managing Director/CEO, Nigeria Sovereign Investment Authority, and Bonaventure Okhaimo, CFO, Development Bank of Nigeria who both presented keynote addresses.

Dr Ishak Demir, a research economist at the World Federation of Exchanges (WFE) made his presentation virtually.

Identifying the roles SMEs will play in the race to become a $1 trillion economy, Dr Demir said SME markets tend to be illiquid in terms of capital in many jurisdictions, calling for the need to remove the bottlenecks that prevent SMEs from raising capital to boost their operations. As SMEs contribute over 50 percent of GDP in most economies of the world, limited access to capital inhibits their contributions to economic growth.

“SMEs play a critical role in economic development, but access to finance can limit their ability to grow their business and, in extreme situations, to survive. The persistent global financing gap of SMEs points to the limitations of bank financing, as a traditional source of external finance, and has resulted in an increased interest in alternative finance channels such as equity instruments,” Dr Demir said.

“Public equity markets act as a solution for addressing the funding shortfall for SMEs, offering access to extensive investment resources and bolstering creditworthiness, market transparency, visibility, and the capacity to secure bank financing and manage debt. The last two decades have seen stock exchanges create or improve SME markets worldwide, and there are currently 49 exchanges among WFE members with SME listing platforms/segments,” Dr Demir said.

Adetilewa Adebajo, CEO, CFG Advisory said the Nigerian economy would have hit the $1 trillion benchmark by now if not for the mismanagement of the economy, emphasising that the last eight years in the life of this country witnessed a huge decline in the worth of the Nigerian economy.

“The Nigerian economy is a $1 trillion economy already if not for the mismanagement of the last eight years. In 2015, our GDP was close to $600 billion and between 2015 and 2023, the country lost about $250 billion. And with the 2023 devaluation, if you add these together, our GDP should be about $850 billion which is just some few billions away from $1 trillion,” Adebajo said.

Olubukola Rufai, Director, Securities & Exchange Commission (SEC), Lagos Office said the SEC has facilitated capital raising exercises for institutions such that approvals are granted within days, a development she said, was to ensure that companies in Nigeria are able to raise capital without hindrances, noting capital hassle-free capital raising exercises for companies will boost Nigeria’s drive towards a $1 trillion economy.

The highpoint of the annual conference was the conferment of fellowships and associates on distinguished members of the society.